HOW TO AVOID PAYING LMI EVEN WITH A 10% DEPOSIT

When buying a property, most lenders will require that you have Lenders Mortgage Insurance (LMI) if you are borrowing more than 80% of the value of the property.

LMI is a one-off, non-refundable payment, due at loan settlement. You can either pay the amount upfront, or you can request that it is added to your total loan from the lender, and pay it off while you make your loan payments.

It is important to note that LMI protects the lender, even though the borrower pays for it. The lender will also arrange it for you.

How much does LMI cost?

LMI can be costly. But the truth is, many first home buyers or lower-income earners would be completely shut out of the property market without LMI, never being able to save up for the deposit. LMI has its benefits for both buyers and lenders.

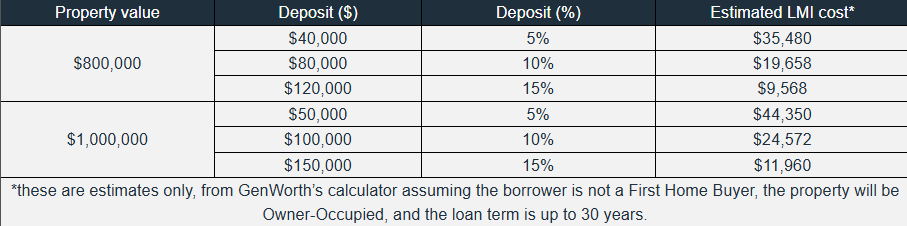

The actual cost for LMI will vary depending on the total amount of the loan, as well as each lender’s policy and terms. As expected, the more you borrow, the higher your LMI premium.

Estimates for LMI are below, using examples of $800,000 and $1,000,000 properties when the borrower is paying less than a 20% deposit.

How can I save on LMI? APFG Has a Solution

To avoid paying LMI, the first and most obvious way is to pay the 20% deposit. However, there are many reasons why a buyer may not have this amount available or as liquid cash when looking to buy a particular property.

(See also: Deposit Bond: A More Efficient Use of Your Cash Deposit)

Through our partners, we have a solution for our clients who want to save on LMI. For buyers with a 10% deposit, select APFG properties will give an LMI rebate, up to $25,000. In some cases, where the LMI is less than $25,000, buyers can receive a rebate covering 100% of their LMI premium.

For our example above, the buyer of a $1,000,000 can use a 10% deposit and recover the LMI in its entirety.

Terms and conditions do apply, and this option is only available on certain properties.

If you are hoping to get into the Gold Coast markets now, taking advantage of the early returns and tremendous forecasted growth, but don’t have the full 20% cash deposit readily available, the APFG solution for avoiding LMI is a viable option that can save you up to $25,000.

See More: Gold Rush: Reaching new heights in Gold Coast’s robust apartment market, and Queensland Reigns Supreme: The jaw-dropping Queensland migration numbers)

Talk to one of our property managers today, to find out more and which properties are offering the LMI rebates.

ACN 650 427 884

Level 10 36 Marine Parade Southport QLD 4215

© 2026 APFG. All Rights Reserved. Powered by geonet.me