CO-LIVING PROPERTIES CAN RESCUE AUSTRALIA FROM THE CRUSHING RENTAL CRISIS

Not since the global financial crisis 13 years ago have Australian tenants experienced their rents jump so high on an annual average. CoreLogic reported Q3 rental prices across the country have increased 8.9% over last year, and rent in regional areas surged over 12.5%, its sharpest annual rise ever.

These hikes correlate with the booming housing market, with the latest numbers showing prices increasing 22% in the last 12 months and 14 consecutive months of positive growth. On average, homeowners and investors enjoyed a boost of approximately $126,700 to the value of their homes. Conversely, the tenants in the best - or worst, depending which side you are observing - areas of NSW and QLD are trading stories of evictions, living in tents, garages, and vehicles, unable to afford their weekly rent payments.

Just how bad is it for Australian tenants?

The Rent Affordability Index for November 2021 highlighted segments of the population whose rent exceeds 30% of income and found increasingly dire situations for students, recent college graduates and entry-level employees, single parent part-time workers, hospitality workers, and pensioners - all of whom face “severely unaffordable to unaffordable rents across most metropolitan and regional areas.”

The RAI also mentions low-income earners are being pushed out of lower cost rentals by higher-earning individuals or couples who are would-be First Home Buyers and are experiencing more difficulties saving deposits due to the high prices of housing.

“The soaring rents are not an issue now for investors, the lack of units is keeping demand high with a large pool of potential tenants,” says Matt Sully, CEO of APFG. “But there will be risks in the future when the rental prices will be unattainable, and investors will still earn their capital gains but may sit with empty properties.”

The lack of available units in regions with growing populations is creating overwhelming demand, with vacancy numbers remaining at all-time lows. More than 40,000 interstate migrants arrived in QLD between 2020-21. Even with pipelines of new developments in progress, housing unit supply is falling behind demand. The situation will only get worse when borders open, and the country reaches its target of welcoming 200,000 international skilled workers and students from abroad.

Co-Living properties are here to save the day!

A solution to the crisis is a new trend in housing - Co-living properties.

Co-living properties are emerging as heroes, saving both renters and investors from the burdens of an unaffordable rental market.

Co-living properties are purpose-built, designed so each bedroom is equally sized, with an ensuite bathroom, along with communal spaces for kitchen, dining, and living areas. Each room and tenant has an individual rental agreement.

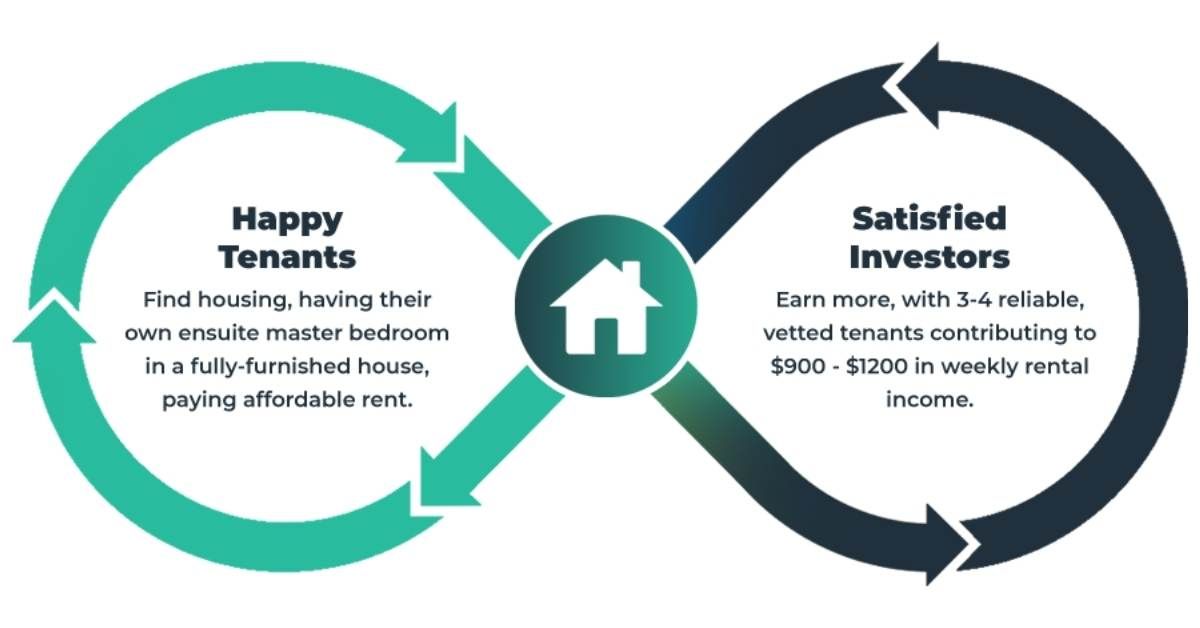

“Co-living is a win-win for both tenants and investors,” says Sully.

Tenants are able to escape the pitfalls of typical shared housing or living in a place that is old or falling apart.. Most importantly, weekly rent is significantly below average, typically around $300 per week depending on the property.

For investors, co-living properties’ benefits include a significant increase in cash-flow, due to the multiple rooms, but also the properties are proving to be a solid, strong investment, even in uncertain times.

“Co-living is the unique opportunity where each space is rented for below average, but the total cash flow for the property is higher,” says Sully. “This segment satisfies the need for affordable housing, but also keeps investors extremely happy with rates of return.”

APFG Co-Living Properties

In February, APFG will launch a brand of Co-living properties, along with dual-key and duplex designs. There will be up to 100 units at first release, in various locations in SE Queensland.

“This is an incredible opportunity for us,” says Sully. “Our clients will have a selection of properties to meet their budget and investment goals, all with cash-flow and ROI potential well above the average of typical properties.”

For more details and to join the waitlist for the first release, contact our team today.

ACN 650 427 884

Level 10 36 Marine Parade Southport QLD 4215

© 2026 APFG. All Rights Reserved. Powered by geonet.me